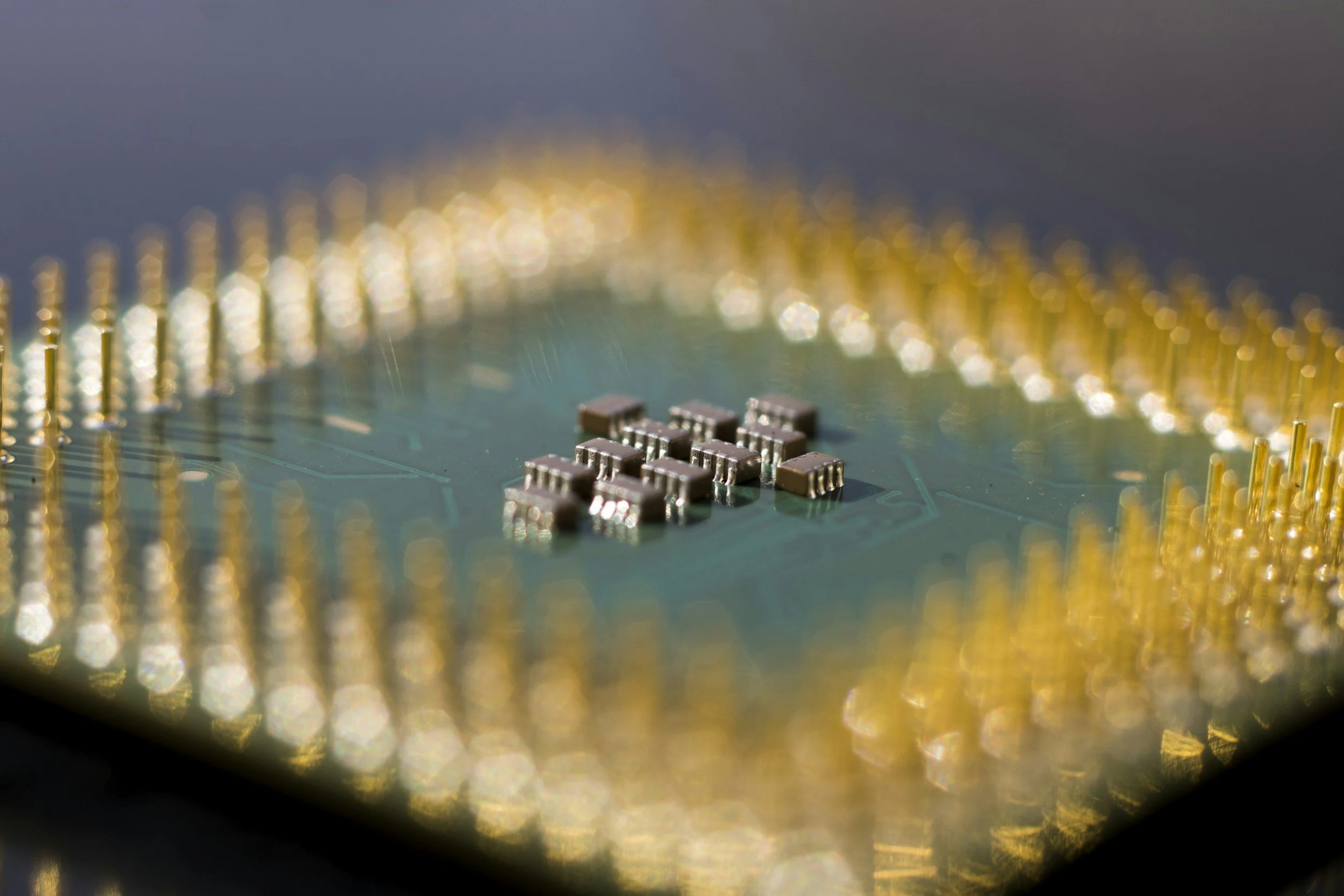

Semiconductor Spending Is Set to Hit $1 Trillion in 2026

Worldwide semiconductor sales climbing 22.5% to more than $772 billion

A surge in spending on artificial intelligence infrastructure in 2026 is set to act as a powerful tailwind for the global semiconductor industry, reinforcing strong growth momentum built over the past year.

The sector enjoyed a robust 2025, with worldwide semiconductor sales climbing 22.5% to more than $772 billion, according to World Semiconductor Trade Statistics (WSTS). That momentum is expected to accelerate. WSTS forecasts a further 26% increase in 2026, taking annual sales close to $975 billion. Bank of America analyst Vivek Arya is even more bullish, projecting industry revenues to rise by about 30% next year to exceed $1 trillion.

At the heart of this expansion is the rapidly intensifying AI boom. Arya believes the AI data centre market alone could reach $1.2 trillion by 2030, growing at an annual rate of 38%. Within that, demand for AI accelerators — including graphics processing units (GPUs) and custom-designed processors — could drive as much as $900 billion in chip sales over time.

Against this backdrop, Arya has identified several semiconductor companies that are well positioned to benefit from both near-term growth in 2026 and longer-term structural demand.

One standout, according to Bank of America, is Nvidia. The company remains the undisputed leader in AI computing, controlling more than 90% of the data centre GPU market. Its chips have been central to the development of large language models and AI inference applications over the past several years.

While competitors such as AMD and Broadcom are investing heavily to narrow the gap, Arya argues that Nvidia’s technological advantage — estimated to be at least a generation ahead — gives it a durable edge. As a result, Nvidia could generate as much as $500 billion in revenue across 2025 and 2026, in line with broader market expectations.

Project News